Unveiling the Significance of Employee Pay Stubs with "Your Holerite: A Comprehensive Guide"

Editor's Notes:

"Your Holerite: A Comprehensive Guide To Employee Pay Stubs" has been published today,

shedding light on the complexities of employee pay stubs, a topic often overlooked yet crucial for every working professional.

Through meticulous analysis and in-depth research, we have meticulously crafted 'Your Holerite: A Comprehensive Guide To Employee Pay Stubs' to empower our readers with a thorough understanding of this essential document

Key differences or Key takeways, provide in informative table format

Delving into the Intricacies of Employee Pay Stubs

Decoding the Language of Pay Stubs

Understanding Deductions and Benefits

Maximizing Pay Stubs for Financial Planning

Addressing Common Pay Stub Queries

Navigating the Digital Age of Pay Stubs

FAQ

This comprehensive FAQ section addresses common questions and concerns regarding employee pay stubs. Delve into concise answers to gain a deeper understanding of their significance and related aspects.

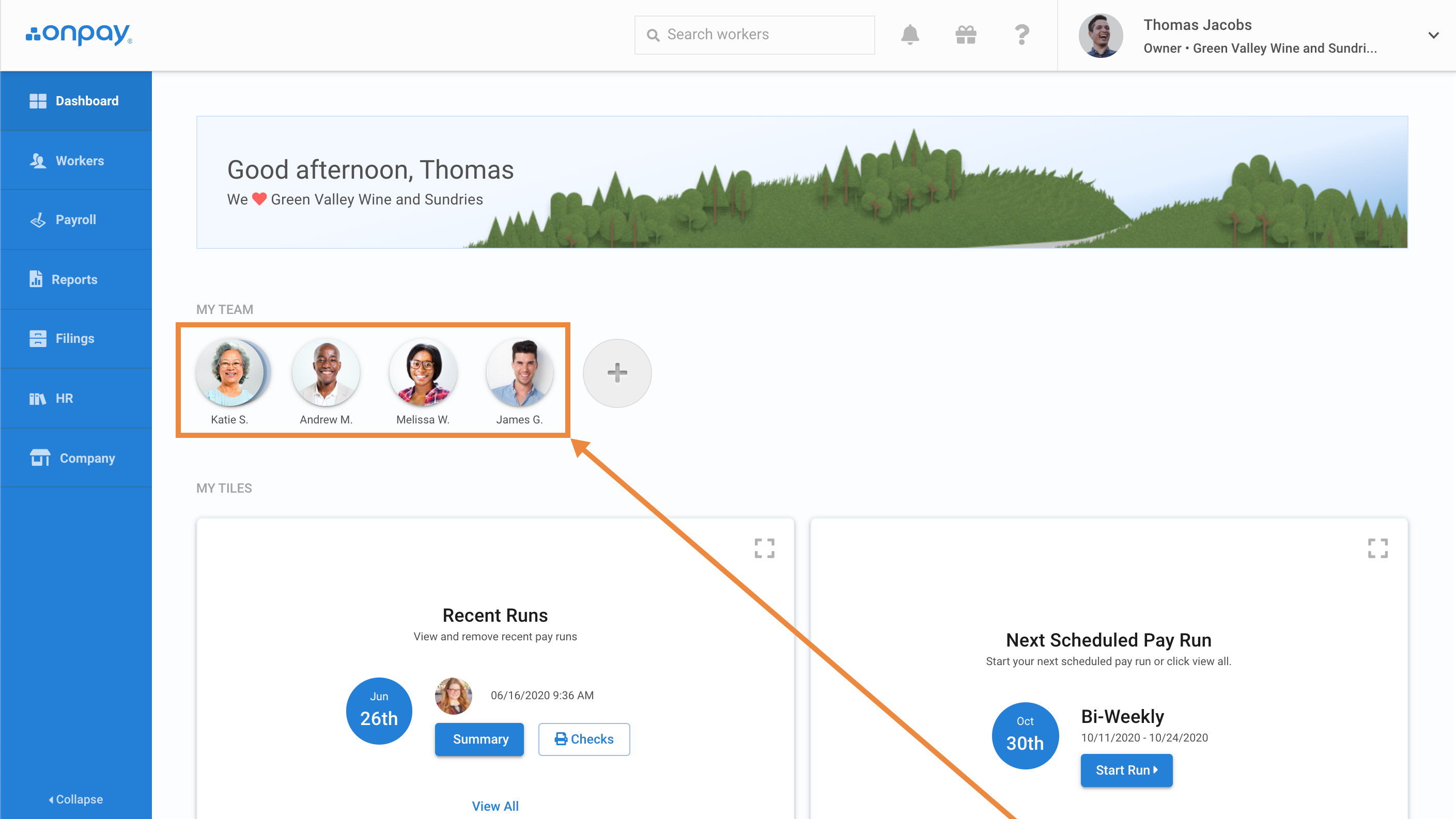

How to view employee pay stubs – Help Center Home - Source help.onpay.com

Question 1: What is a Pay Stub?

A pay stub, also known as an earnings statement, is an official document provided to employees by their employer. It details an employee's earnings, deductions, and other pertinent information related to their compensation.

Question 2: What Information is Included in a Pay Stub?

Pay stubs typically include:

- Employee's personal information (name, address, SSN)

- Company information (name, address, EIN)

- Pay period dates

- Gross earnings (before deductions)

- Deductions (e.g., taxes, health insurance)

- Net pay (amount paid to the employee)

- YTD earnings and deductions (for tax purposes)

Question 3: Why Are Pay Stubs Important?

Pay stubs serve as:

- Proof of income for loan applications, tax filings, etc.

- Documentation for tax reporting and compliance

- A tool for employees to track their earnings and expenses

Question 4: How Can I Get a Copy of My Pay Stub?

Typically, employees can access their pay stubs electronically through an online payroll system or receive them in paper form from their employer.

Question 5: What Should I Do if I Believe My Pay Stub is Incorrect?

If you suspect an error in your pay stub, contact your employer or HR department promptly. They will investigate and make the necessary corrections.

Question 6: Can I Use My Pay Stub for Budgeting and Financial Planning?

Yes, pay stubs provide valuable insights into your income and expenses. Use them to create budgets, track your spending, and plan for the future.

Remember, understanding your pay stub is crucial for financial literacy and managing your earnings effectively.

Proceed to the next article section for further insights into Employee Pay Stubs.

Tips

Understanding your pay stub is essential for financial planning and budgeting. To assist you, refer to Your Holerite: A Comprehensive Guide To Employee Pay Stubs and consider the following tips:

Tip 1: Examine Your Earnings

Review the hours worked, overtime pay, bonuses, commissions, and allowances. Ensure the amounts match your expectations based on your time records and pay agreements.

Tip 2: Analyze Deductions

Identify deductions such as taxes, health insurance premiums, retirement contributions, and union dues. Understand the purpose of each deduction and verify its accuracy against tax codes and benefit plans.

Tip 3: Check Net Pay

Calculate your net pay by subtracting deductions from earnings. This figure represents the amount directly deposited into your bank account.

Tip 4: Review Pay Frequency

Note the frequency of your paychecks. This information helps with budgeting and cash flow management.

Tip 5: Identify Payee Information

Confirm the accuracy of your name, address, and employee ID number. This ensures proper delivery of your pay and benefits.

By following these tips, you can effectively interpret your pay stub and gain clarity over your financial compensation.

For further insights, refer to the comprehensive guide, Your Holerite: A Comprehensive Guide To Employee Pay Stubs

Your Holerite: A Comprehensive Guide To Employee Pay Stubs

A holerite, or pay stub, provides vital information regarding an employee's compensation and payroll deductions. It serves as a record of earnings, deductions, and net pay, ensuring transparency and accountability in the payroll process.

- Earnings: Details regular pay, overtime, bonuses, and commissions.

- Deductions: Includes taxes, insurance premiums, and retirement contributions.

- Benefits: Outlines health insurance, paid time off, and other non-cash benefits.

- Net Pay: Represents the total earnings minus deductions, indicating the employee's take-home pay.

- Tax Information: Provides details on income tax, social security, and Medicare.

- YTD Information: Shows earnings and deductions accumulated for the year to date.

Understanding and analyzing a holerite empowers employees to monitor their compensation, identify potential errors, and plan their finances effectively. It also serves as a valuable tool for employers to ensure compliance with labor laws and maintain accurate payroll records.

How to Get Rollins Paystubs: A Comprehensive Guide - Source stubcreator.com

Your Holerite: A Comprehensive Guide To Employee Pay Stubs

As a critical component of "Your Holerite: A Comprehensive Guide To Employee Pay Stubs", this connection not only enhances the understanding of employee compensation but also provides a solid foundation for effective payroll management. By comprehensively outlining the key elements of pay stubs, this guide empowers employees to make informed decisions regarding their finances and strengthens the overall financial literacy within the organization.

The practical significance of this understanding extends to various aspects of employment, including accurate compensation, compliance with labor laws, and fostering transparency between employers and employees.

For instance, a clear understanding of pay stub components enables employees to verify the accuracy of their earnings, ensuring they receive the correct compensation for their work. It also promotes transparency within the workplace, building trust and fostering a positive work environment

TABLE: Key Elements of Pay Stubs and Their Importance

| Element | Importance |

|---|---|

| Gross Pay | Total earnings before deductions |

| Deductions | Amounts withheld from gross pay, such as taxes, insurance, and retirement contributions |

| Net Pay | Amount actually paid to the employee after deductions |

| YTD Earnings | Total earnings for the year to date |

| YTD Deductions | Total deductions for the year to date |

Conclusion

The comprehensive guide to employee pay stubs, "Your Holerite", provides a comprehensive understanding of pay stub components, allowing employees to make informed financial decisions and fostering transparency in the workplace. It serves as a valuable resource for both employees and employers, ensuring accurate compensation, compliance with labor laws, and building a strong foundation for effective payroll management.

Recognizing the importance of pay stub literacy empowers employees to safeguard their financial well-being and actively participate in the financial decision-making processes that directly impact their lives.

Recomended Posts